You’ve been saving gold jewelry for years. Maybe it’s your grandmother’s necklace, a wedding gift, or coins you bought as an investment. Now Ramadan is approaching, and you’re wondering: “Do I owe Zakat on this? But wait—gold prices keep changing. How am I supposed to calculate this correctly?”

If you’ve ever felt confused about when gold price fluctuations affect your Zakat obligation, you’re not alone. Thousands of Muslims face this same question every year, especially in 2026 when gold prices have been particularly volatile.

Let’s clear up the confusion once and for all.

The Basic Rule: What Never Changes

Before we dive into gold prices, let’s establish what stays the same. According to Islamic teachings, Zakat on gold follows three simple rules:

Rule #1: The Nisab Threshold

You only owe Zakat if you own at least 87.48 grams of gold (about 3 ounces). This is called the Nisab. If you own less than this amount, you don’t owe Zakat on your gold at all.

Rule #2: The One-Year Rule

You must have owned the gold for one full lunar year (hawl). So if you received gold jewelry as a gift three months ago, you don’t owe Zakat on it yet. Wait until the full year passes.

Rule #3: The 2.5% Rate

If you meet the Nisab and the one-year requirement, you pay 2.5% of the gold’s current value. This percentage never changes, regardless of how gold prices move.

These three rules are set in stone. They don’t change whether gold costs $2,000 per ounce or $3,000 per ounce.

Where the Confusion Comes In: Daily Price Changes

Here’s where people get stuck. You check the gold price today, and it’s $2,650 per ounce. Tomorrow it might be $2,680. Next week? Maybe $2,600.

So which price do you use?

The answer is beautifully simple: You use the gold price on the exact day your Zakat becomes due.

Think of it like checking your bank balance. If your Zakat year ends on March 15th, you check the gold price on March 15th—not last month’s price, not next month’s price. Just that day.

A Real Example

Let’s say you own 100 grams of 22-karat gold jewelry. You’ve had it for over a year, so it’s definitely eligible for Zakat.

On February 10, 2026, gold was trading around $2,650 per ounce (approximately $85 per gram). Your 100 grams would be worth about $8,500.

Your Zakat calculation:

$8,500 × 2.5% = $212.50

But what if gold prices jump to $2,800 per ounce by the time your Zakat is due on March 15th? Then your gold would be worth about $9,000, and your Zakat would be:

$9,000 × 2.5% = $225

The key point: You only calculate once—on your Zakat due date. You don’t need to track every daily price change throughout the year.

Common Mistakes People Make

Mistake #1: Using Last Year’s Gold Price

Some people think, “I calculated my Zakat last Ramadan using the gold price from 2025. Can’t I just use the same price again?”

No. Gold prices change significantly year to year. In early 2026, gold has been especially volatile. Using outdated prices can lead to underpaying or overpaying your Zakat—neither of which is ideal.

Always check current prices on your Zakat due date.

Mistake #2: Averaging Gold Prices Throughout the Year

You might think, “Gold was $2,500 in January and $2,700 in December. I’ll just average it to $2,600.”

That’s not how it works. Islamic scholars are clear: use the market value on the specific day your obligation becomes due. Averaging is unnecessary and can lead to confusion.

Mistake #3: Worrying About Small Daily Fluctuations

“But what if the price changes between morning and evening on my Zakat day?”

Relax. You’re not required to calculate down to the minute. Use a reputable source for the day’s gold price—whether that’s a morning price or afternoon price—and move forward. Allah knows your intention, and a difference of $5-10 per ounce won’t significantly change your obligation.

Mistake #4: Forgetting About Different Gold Purities

Not all gold is created equal. Your 18-karat bracelet contains less pure gold than a 24-karat coin.

When calculating Zakat:

- 24-karat (pure gold): Use the full weight

- 22-karat: About 91.6% pure gold

- 18-karat: About 75% pure gold

- 14-karat: About 58.3% pure gold

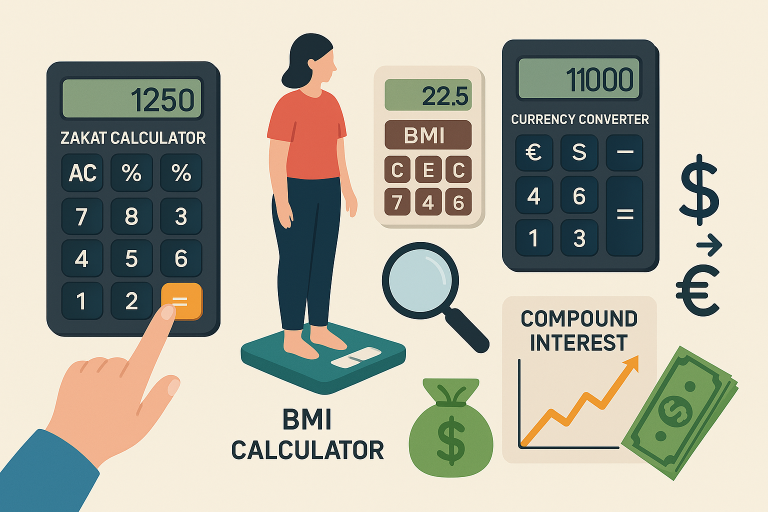

Many Zakat calculators (like the one at Decimaly.com) automatically adjust for purity. Just enter your gold’s karat value, and the calculator does the rest.

What Happens If Gold Prices Drop During the Year?

Here’s a scenario that confuses many people:

You started the year with 100 grams of gold worth $8,500 (above the Nisab). Midway through the year, gold prices crashed, and your gold dropped to $6,000 (below the Nisab). Then by year’s end, prices recovered to $8,800.

Do you still owe Zakat?

According to most scholars, yes. If your wealth was above the Nisab at the beginning of your Zakat year and at the end, Zakat is due—even if it dipped below during the middle months.

However, if your wealth falls below Nisab and stays there at the end of the year, the Zakat obligation doesn’t apply.

The safest approach? Calculate based on what you own on your Zakat due date.

Gold vs. Silver Nisab: Another Source of Confusion

Here’s something that trips up even knowledgeable Muslims: Should you calculate your Nisab using gold or silver?

The traditional Nisab values are:

- Gold: 87.48 grams (about $7,500-$8,500 in 2026)

- Silver: 612.36 grams (about $500-$700 in 2026)

Notice the huge difference? The silver Nisab is much lower.

Many scholars recommend using the silver Nisab because:

- It means more people can fulfill their Zakat obligation

- It benefits more people in need

- It’s the more cautious approach

But here’s what this means for your gold: Even if your gold doesn’t reach the gold Nisab (87.48 grams), if your total wealth (including cash, investments, and that gold) exceeds the silver Nisab, you may still owe Zakat.

This is why many people use a comprehensive Zakat calculator that combines all their assets.

How to Calculate Without Getting Overwhelmed

The easiest way to avoid confusion? Follow these five steps:

Step 1: Mark Your Zakat Date

Choose a date each year—many Muslims use the 1st of Ramadan. Mark it on your calendar.

Step 2: Gather Your Gold

On that date, collect all your gold jewelry, coins, and bars. Get the total weight in grams.

Step 3: Know Your Purity

Check if it’s 18k, 21k, 22k, or 24k gold. This is usually stamped on jewelry.

Step 4: Check Current Gold Price

On your Zakat date, look up the current gold price per gram. Many Islamic charities and websites publish daily rates.

Step 5: Use a Calculator

Plug the numbers into a reliable Zakat calculator (like Decimaly’s Gold Zakat Calculator). It will:

- Adjust for gold purity

- Check if you meet the Nisab

- Calculate the exact 2.5% owed

Done. No stress, no confusion.

Special Cases: Jewellery You Actually Wear

This is the million-dollar question: “Do I pay Zakat on my wedding ring that I wear every day?”

The answer depends on which Islamic school of thought you follow:

Hanafi school: You pay Zakat on ALL gold, whether you wear it or not.

Maliki, Shafi’i, and Hanbali schools: You generally do NOT pay Zakat on jewellery you regularly wear for adornment.

Stored or unused jewellery: ALL schools agree you pay Zakat on gold stored in a safe that you never wear.

If you’re unsure, consult with a trusted Islamic scholar or follow the more cautious opinion (Hanafi), which includes all gold.

When Gold Prices Surge: A Blessing, Not a Burden

Some people get anxious when gold prices rise. “I paid $7,000 for this gold last year. Now it’s worth $9,000. Do I really have to pay Zakat on the full $9,000?”

Yes—and here’s why that’s actually a good thing.

If your gold increased in value, that means Allah has blessed you with more wealth. The Zakat you pay (2.5%) is a small portion of that blessing, helping those who desperately need it.

Think about it this way: Would you rather have $9,000 worth of gold and pay $225 in Zakat, or $7,000 worth of gold and pay $175? The choice is obvious.

Rising gold prices mean your wealth is growing. Zakat is the purification of that growth.

Practical Tips for 2026

Gold prices in early 2026 have been notably volatile. Here’s how to handle it wisely:

Tip #1: Don’t Wait Until the Last Minute

If you scramble on the 29th of Ramadan to calculate Zakat, you’ll stress yourself out. Set a reminder two weeks before your Zakat date.

Tip #2: Keep Records

Write down the date you acquired each piece of gold. This makes the one-year rule easy to track.

Tip #3: Use Trusted Price Sources

Don’t just Google “gold price” and use the first result. Use:

- Islamic Relief’s daily gold rates

- Muslim Aid’s Zakat calculator

- Decimaly’s Gold Zakat Calculator (with live prices)

- Your local jeweller (they usually know current rates)

Tip #4: When in Doubt, Round Up

If you’re stuck between two gold price quotes, use the higher one. It’s better to pay a bit extra than risk underpaying.

Tip #5: Consider Paying Early

If gold prices are currently high and you expect them to drop, you can pay your Zakat early (but only after your year of ownership is complete). This way, you lock in your obligation before prices potentially fall.

What About Gold Stored in Other Countries?

Many Muslims have gold stored back home with family or in a safe deposit box abroad. Does that count?

Yes, absolutely. Zakat is based on ownership, not location. If you own 100 grams of gold sitting in Pakistan, India, or Egypt, and you’ve owned it for a year, you owe Zakat on it—regardless of where it physically sits.

Calculate its value using the gold price in your current country of residence (where you’ll be paying the Zakat). Don’t try to convert between currencies and gold markets. Just use one standard rate.

The Bottom Line: Stop Overthinking It

Zakat on gold is simpler than most people think. Yes, gold prices change daily. But your obligation is straightforward:

✅ Check if you meet the Nisab (87.48 grams of gold)

✅ Confirm you’ve owned it for one lunar year

✅ Look up the gold price on your Zakat due date

✅ Calculate 2.5% of the total value

✅ Pay it promptly

That’s it. You don’t need to track gold prices all year. You don’t need a finance degree. You just need to be honest, use current prices on the right day, and fulfill your obligation.

The Prophet Muhammad (peace be upon him) kept Islamic obligations simple and accessible. Don’t complicate what Allah has made easy.

Use Technology to Your Advantage

In 2026, we’re blessed with tools that make Zakat calculation effortless. Websites like Decimaly.com offer free Gold and Silver Zakat Calculators that:

- Update gold prices automatically (daily)

- Adjust for different gold purities (18k, 21k, 22k, 24k)

- Tell you instantly if you’ve reached Nisab

- Calculate your exact Zakat amount in seconds

- Work for any currency (USD, EUR, GBP, SAR, etc.)

Why stress over manual calculations when technology can do it for you in 30 seconds?

Calculate Your Gold Zakat Now →

Final Thoughts: The Spirit Behind the Numbers

Remember, Zakat isn’t just about numbers and percentages. It’s about purifying your wealth and helping those in need.

When gold prices rise, and your Zakat amount increases, don’t see it as a burden—see it as:

- Proof that Allah has blessed you with more

- An opportunity to help more people

- A way to purify even greater wealth

When gold prices fall, don’t try to game the system. Calculate honestly, pay what’s due, and trust that Allah sees your intention.

The confusion around gold prices shouldn’t stop you from fulfilling this beautiful pillar of Islam. Armed with the right knowledge and tools, you can calculate your Zakat with confidence—no matter how much gold markets fluctuate.

Gold may change in value from day to day, but your obligation to care for those in need? That remains priceless.

Ready to calculate your Zakat accurately? Use Decimaly’s free Gold Zakat Calculator with live gold prices updated daily. No confusion, no guesswork—just accurate calculations in under a minute.