What is a Compound Interest Calculator?

A Compound Interest Calculator helps you see how money grows when interest is added not just to your initial deposit, but also to the interest already earned. This “interest on interest” effect is the secret behind wealth growth over time.

On Decimaly, our Compound Interest Calculator is designed for:

- 📊 Planning savings goals

- 💰 Forecasting investment growth

- 🏦 Comparing daily, monthly, and yearly compounding

- 🎯 Seeing the effect of monthly contributions instantly

👉 Try it below and watch your money multiply!

Use Compound Interest Calculator Now

How to Use Decimaly’s Compound Interest Calculator

- Enter Initial Deposit (Principal) – e.g., 1,000.

- Annual Interest Rate (APR) – Enter the yearly rate, e.g., 7%.

- Compounding Frequency – Select Daily, Monthly, or Yearly.

- Monthly Contribution (Optional) – Add how much you save each month.

- Time Period (Years) – Choose how long you want to invest or save.

- Click “Calculate” – Instantly see Future Value, Total Contributions, and Interest Earned.

💡 Tip: Use different compounding options to see which grows faster.

Example Calculations

Scenario 1: Monthly Savings Plan

- Initial Deposit: $1,000

- APR: 7%

- Compounding: Monthly

- Contribution: $200/month

- Time: 10 years

➡️ Future Value: ~ $35,000

➡️ Interest Earned: ~ $10,000

Scenario 2: Long-Term Growth with Daily Compounding

- Initial Deposit: $2,000

- APR: 8%

- Contribution: $150/month

- Time: 20 years

- Compounding: Daily

➡️ Future Value: $130,000+

➡️ Interest Earned: $90,000+

Why Compounding Frequency Matters

- Daily compounding → best growth, small edge over monthly.

- Monthly compounding → standard in most banks.

- Yearly compounding → simplest but grows slower.

The longer your money stays invested, the more daily vs. monthly matters.

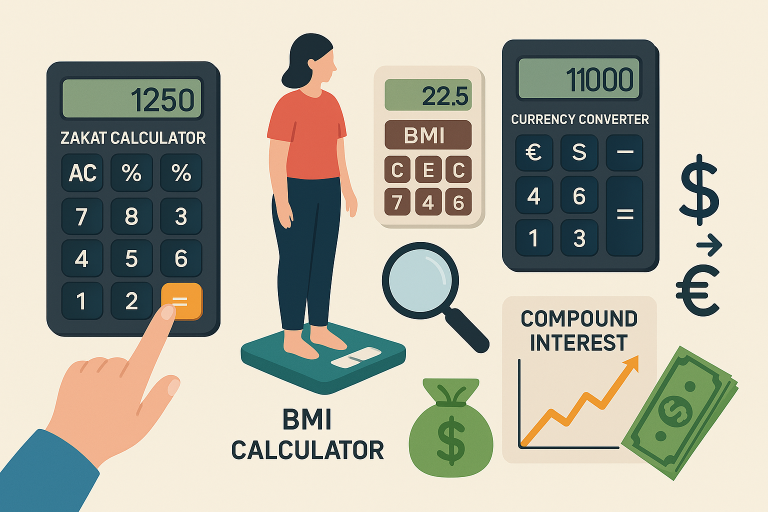

Formula Behind the Calculator

Where:

- PPP = Initial deposit

- rrr = Annual interest rate (decimal)

- nnn = Compounding periods per year

- ttt = Years

- PMTPMTPMT = Monthly contribution

FAQs

Q1: Is daily compounding always better than monthly?

Yes, but the difference is small unless the time horizon is long.

Q2: Can I use this calculator for retirement planning?

Absolutely! It’s perfect for long-term savings like retirement, education, or buying a home.

Q3: Why does my result differ from my bank statement?

Banks use different compounding rules. Select the same frequency your bank uses for accuracy.

Q4: What interest rate should I assume?

Try 5% (conservative), 7% (moderate), and 9% (optimistic) to plan realistically.

Related Tools on Decimaly

- Currency Converter – Plan investments abroad

- Zakat Calculator – Calculate annual obligations on savings

- BMI Calculator – Track your health alongside wealth

Call-to-Action

🚀 Ready to watch your money grow?

Try Decimaly’s Compound Interest Calculator now and plan your future with confidence.

Simply desire to say your article is as astonishing. The clearness in your post is just spectacular and

i could assume you are an expert on this subject. Well with your permission allow me

to grab your feed to keep updated with forthcoming post. Thanks a million and please

keep up the gratifying work.