Introduction

You’ve opened a compound interest calculator, punched in some numbers, and watched the magic happen. Your $10,000 investment could become $50,000 in 20 years! But wait—when you check back five years later, your actual returns don’t match those rosy projections. What went wrong?

Compound interest calculators are powerful tools, but they’re only as good as the numbers you feed them. Even small input errors can lead to wildly inaccurate predictions, costing you thousands in lost opportunity or misplaced confidence. Let’s break down the five most common mistakes people make—and how to get your calculations right.

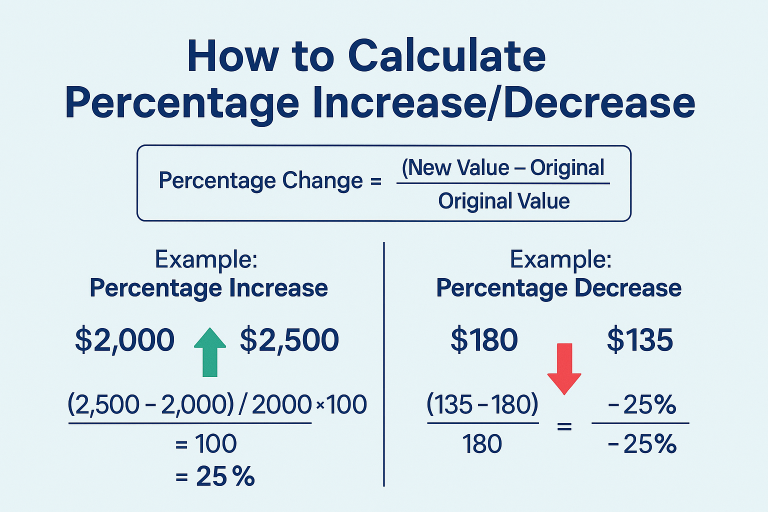

Mistake #1: Adding Returns Instead of Compounding Them

The Error: Many people assume that if they earn 10% one year and 8% the next, their total return is simply 18%.

The Reality: Returns compound on the new total, not the original amount. This isn’t just addition—it’s multiplication working in your favor.

Real-Life Example: Sarah invests $10,000 in a mutual fund. In Year 1, she earns a 10% return, bringing her balance to $11,000. In Year 2, she earns 8%—but that 8% applies to $11,000, not the original $10,000.

- Wrong calculation: 10% + 8% = 18% total return = $11,800

- Correct calculation: Year 1: $10,000 × 1.10 = $11,000 | Year 2: $11,000 × 1.08 = $11,880

That’s an extra $80—and over decades, these differences snowball into thousands.

How to Fix It: When using a compound interest calculator, never manually add yearly returns together. Input each year’s rate separately or use the compound annual growth rate (CAGR) if returns vary. Remember: compounding means your gains earn gains.

Mistake #2: Mixing Up Compounding Periods

The Error: You see “5% annual interest” and assume it’s calculated once per year, when the fine print says “compounded monthly” or “compounded daily.”

The Reality: The compounding frequency dramatically affects your results. Monthly compounding gives you more money than annual compounding at the same stated rate.

Real-Life Example: Two friends, Alex and Jordan, each invest $5,000 at 6% annual interest for 10 years.

- Alex’s account: Compounded annually = $8,954

- Jordan’s account: Compounded monthly = $9,096

Jordan earns an extra $142 just because interest was calculated and added 12 times per year instead of once. That’s the power of frequency.

How to Fix It: Always check the compounding period in your calculator. Most calculators have a dropdown menu for “annual,” “semi-annual,” “quarterly,” “monthly,” or “daily.” Match this exactly to what your bank or investment account offers. If you’re comparing two investments, make sure they use the same compounding period—or convert them to Annual Percentage Yield (APY) for apples-to-apples comparison.

Pro Tip: Online banks often advertise APY instead of APR specifically because it accounts for compounding frequency and gives you the true annual return.

Mistake #3: Forgetting to Account for Additional Contributions

The Error: You input your initial investment and interest rate, but forget to tell the calculator about your monthly contributions.

The Reality: Regular contributions accelerate wealth-building far more than a single lump sum. This is how most people actually save—through consistent monthly deposits from their paycheck.

Real-Life Example: Meet two investors with very different strategies:

Investor A: Deposits $10,000 once and lets it grow at 7% for 30 years

- Result: $76,123

Investor B: Deposits $10,000 initially, then adds $200 every month at 7% for 30 years

- Result: $253,357

Investor B ends up with over three times more money, thanks to those consistent $200 monthly contributions. That’s the difference between a comfortable retirement and an extravagant one.

How to Fix It: Most compound interest calculators have a field for “monthly contribution” or “periodic deposits.” Don’t leave it blank or at zero if you plan to add money regularly. This is especially critical for retirement planning—401(k)s and IRAs are built on the assumption of regular contributions.

Reality Check: Even if you can only afford $50 or $100 per month right now, input it. Seeing how those small amounts grow can be incredibly motivating.

Mistake #4: Using “Average Returns” Instead of Actual Sequence

The Error: You plug in “8% average annual return” based on historical stock market performance and call it a day.

The Reality: Real investments don’t grow in a straight line. A 20% gain followed by a 12% loss doesn’t average out the same way as steady 8% gains each year—even though both technically average to 8%.

Real-Life Example: Two portfolios both claim an “8% average annual return” over two years, starting with $100,000:

Portfolio A:

- Year 1: +20% → $120,000

- Year 2: -12% → $105,600

- Actual return: +5.6% total

Portfolio B:

- Year 1: +8% → $108,000

- Year 2: +8% → $116,640

- Actual return: +16.64% total

Portfolio B wins by over $11,000, despite having the same “average” return. Why? Because negative returns hurt more than positive returns help—this is called sequence of returns risk.

How to Fix It: If you’re projecting long-term growth, use conservative estimates (6-7% for stocks rather than the historical 10%). Better yet, run multiple scenarios: best case, worst case, and realistic case. Many advanced calculators let you model volatility or run “Monte Carlo simulations” that account for market ups and downs.

Key Insight: This is why financial advisors harp on “not losing money.” A 50% loss requires a 100% gain just to break even.

Mistake #5: Ignoring Fees, Taxes, and Inflation

The Error: Your calculator shows $500,000 in 30 years, and you assume that’s what you’ll actually have to spend.

The Reality: Fees, taxes, and inflation are the silent wealth killers. That $500,000 might only have the buying power of $250,000 in today’s dollars.

Real-Life Example: Emma uses a compound interest calculator to project her 401(k) growth. She inputs:

- Starting balance: $50,000

- Monthly contribution: $500

- Interest rate: 8%

- Time: 25 years

- Calculator result: $778,016

Looks amazing! But Emma forgot three things:

- Investment fees: Her mutual fund charges a 1% annual management fee. Over 25 years, this costs her approximately $155,603 in lost growth.

- Taxes: When she withdraws, she’ll pay 22% income tax on most of it, leaving her with roughly $606,652.

- Inflation: At 3% annual inflation, $606,652 in 25 years has the purchasing power of about $284,750 today.

Her “real” retirement nest egg is less than half of what the basic calculator showed.

How to Fix It:

- Subtract fees: If your investment charges 0.5%-1% annually, reduce your expected return by that amount (8% return – 1% fee = 7% actual growth).

- Plan for taxes: Use a “tax-advantaged account calculator” that factors in whether your money is in a Roth IRA (tax-free growth) vs. traditional 401(k) (taxed on withdrawal).

- Adjust for inflation: Look for calculators with an “inflation adjustment” toggle, or manually subtract 2-3% from your projected returns to see “real” purchasing power.

Pro Move: Sites like Decimaly.com offer compound interest calculators that let you toggle these variables on and off so you can see their true impact.

The Bottom Line: Garbage In, Garbage Out

Compound interest calculators are incredible tools—they can help you visualize your financial future and motivate you to start investing today. But like any tool, they only work if you use them correctly.

Here’s your action plan:

- Double-check your compounding period (annual, monthly, daily)

- Input your regular contributions, not just the lump sum

- Use realistic, conservative return estimates (6-7%, not 10-12%)

- Account for fees, taxes, and inflation to see your “real” money

- Never just add returns together—let the calculator do the compounding math

Small mistakes in a calculator can lead to big disappointments in real life. But get these five things right, and you’ll have a financial roadmap you can actually trust.

Ready to crunch the numbers the right way? Head over to Decimaly’s Compound Interest Calculator and start planning your financial future with confidence—no guesswork, just clear, accurate projections.

Remember: The best time to start investing was 10 years ago. The second-best time is today. Even if you’re starting with just $50 a month, the magic of compound interest will work in your favor—as long as you calculate it correctly.

Have you made any of these mistakes? Share your compound interest horror stories (or success stories!) in the comments below.